Navigating The Volatile Waters Of The US Stock Market: Insights And Strategies For Investors

Introduction:

The US stock market has long been a hub of economic activity and a source of wealth creation for investors. However, it is also known for its inherent volatility and unpredictability. The market’s constant fluctuations can be both exciting and nerve-wracking, making it essential for investors to gain a deep understanding of its dynamics and develop effective strategies to navigate through its ups and downs. In this article, we will explore key insights into the US stock market, discuss strategies for successful investing, and address common questions that investors often have.

Body:

- Understanding the US Stock Market: The US stock market consists of various exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq, where publicly traded companies list their shares. It provides a platform for investors to buy and sell stocks, bonds, and other financial instruments. Here are some important factors to consider when analyzing the US stock market:

- Economic Indicators: Economic indicators, such as GDP growth, employment rates, and inflation, greatly impact the stock market. Positive economic indicators generally drive stock prices higher, while negative indicators can lead to market downturns.

- Market Indices: The most commonly known market indices in the US are the Dow Jones Industrial Average (DJIA), the S&P 500, and the Nasdaq Composite. These indices track the performance of a select group of stocks and provide a snapshot of the overall market sentiment.

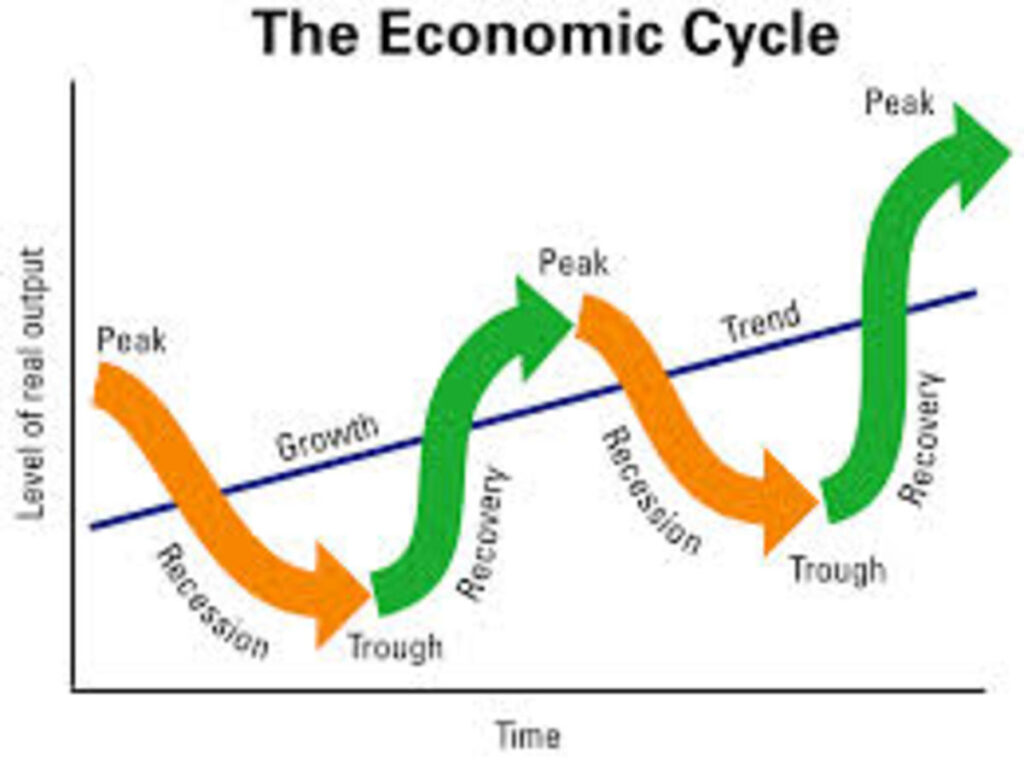

- Market Trends: The US stock market experiences various trends, including bull markets (rising prices) and bear markets (falling prices). Understanding these trends can help investors make informed decisions about buying or selling stocks.

II. Strategies for Successful Investing: Investing in the US stock market requires a well-thought-out approach and a long-term perspective. Here are a few strategies to consider:

- Diversification: Diversifying your investment portfolio is crucial to reduce risk. By investing in a variety of sectors and asset classes, you can offset losses in one area with gains in another. Diversification can be achieved through mutual funds, exchange-traded funds (ETFs), or index funds.

- Fundamental Analysis: Fundamental analysis involves evaluating a company’s financial health, including its revenue, earnings, debt levels, and competitive positioning. By conducting thorough research, investors can identify undervalued stocks with the potential for long-term growth.

- Dollar-Cost Averaging: Rather than trying to time the market, dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy reduces the impact of short-term market volatility and allows investors to accumulate shares over time.

III. Frequently Asked Questions (FAQs):

Q1. Is investing in the stock market risky? A1. Yes, investing in the stock market carries inherent risks. Stock prices can fluctuate significantly, and there is always a possibility of losing money. However, historical data has shown that over the long term, the stock market has provided higher returns compared to other investment options.

Q2. How can I minimize the risk of investing in the stock market? A2. While it is impossible to eliminate all investment risks, you can minimize them through diversification, conducting thorough research, and investing for the long term. Additionally, working with a qualified financial advisor can help you make informed decisions based on your risk tolerance and investment goals.

Q3. Should I invest in individual stocks or opt for index funds? A3. The choice between individual stocks and index funds depends on your investment objectives and risk tolerance. Investing in individual stocks requires more research and carries higher risks but also offers the potential for higher returns. Index funds, on the other hand, provide diversification and generally have lower fees